Unprecedented times call for innovative ideas and new processes. Halderman Real Estate Services had 10 upcoming auctions in the market when

the US government, as well as state governments, shut down face-to-face interactions. Two of these auctions were online only auctions already.

The decision of what to do was easy, convert all auctions to online and phone bidding - now and into the near future.

All ten auctions are complete. Seven of those properties sold during the auction event. One sold within 24 hours after the bidding. The other two did not sell, although the prices achieved were in line with the average values obtained by Halderman this year. What did we learn about the market post COVID 19 outbreak?

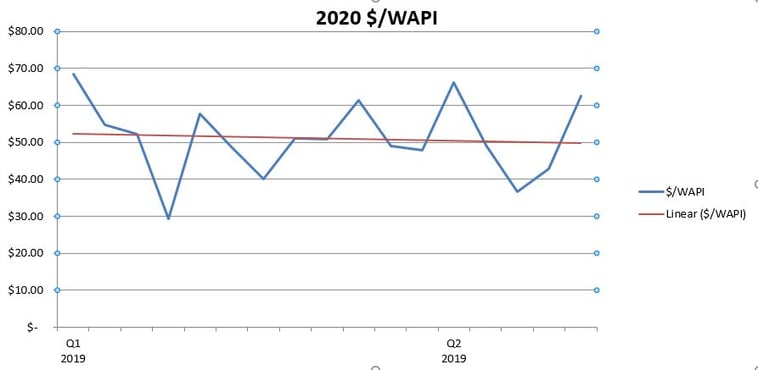

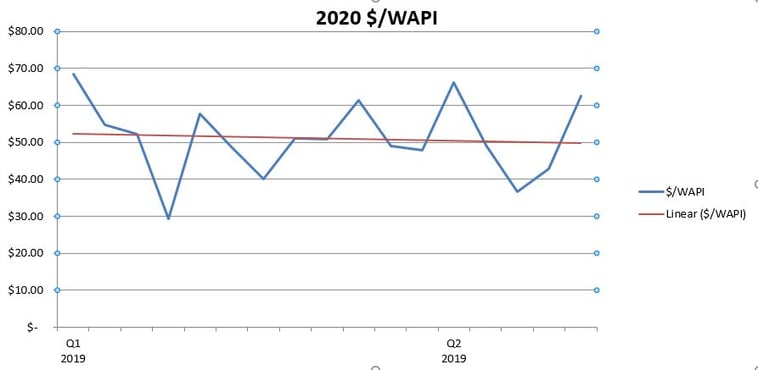

Below is a chart we use to track the market in our region, the eastern corn belt. This chart shows our farm sales from January 1, 2020 – April 22, 2020. We calculate the Weighted Average Productivity Index (WAPI) for each farm based on its soil types in the cropland areas. In Indiana, the WAPI can range from the low 100 bushels/acre of corn to nearly 180 bushels/acre of corn. Generally, actual corn yields will be better than the WAPI, but the WAPI is a good way to compare farms within a state.

We only include farms that are 90% cropland. While the year to date trend is down slightly, the average for the year is $51.11/WAPI bu. while the average for April is $50.90/WAPI bu. This means that if your farm has a WAPI of 155.2 bushels of corn/acre based on its soil types the value might be $7,900/acre (155.2 bu. multiplied by $50.90/WAPI bu.).

The farms we sold in April were generally average. The online auctions in April generated dollars per bushel at 99.58% of the live events held prior to the COVID 19 outbreak. The farmland market remained steady throughout the challenging economic environment!

The future, as of the end of April, remains very cloudy. Commodity prices are low, below cost of production, and the general economy is shutdown. These two factors will push farmland values downward. On a positive note, interest rates are low, government support programs will help offset low commodity prices and there are very few farms for sale. The low supply is normal for planting season and likely, the market remains thin for a couple of months waiting for more direction.

Farmland owners know they have a solid investment. The steady market through April shows the resiliency of farmland and that people like to invest in what they can see, touch and feel. Also, farmland tends to be an inflation hedge. If the government stimulus leads to inflation, historically owning farmland is wise.

If you are thinking about or need to sell your farm, I encourage you to reach out to Halderman at 800-424-2324 and we can help guide you through the process. We can help you identify pricing, timing and the best way to maximize your farmland investment.