Location, Location, Location

By Lindsay Humphrey

Halderman Vice President Pat Karst sheds some light on the WAPI, what the buyer pool looks like, and how the two interact.

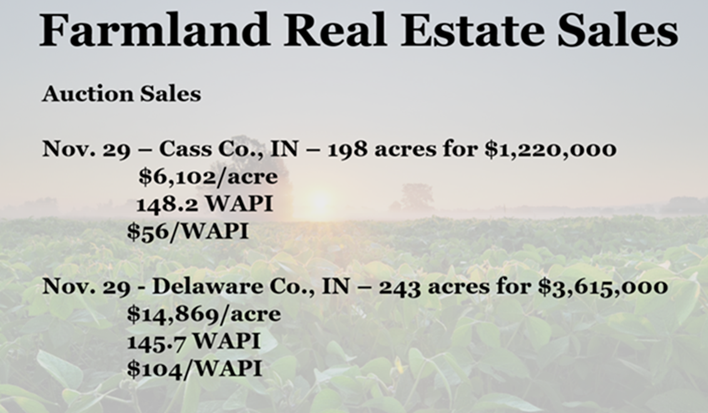

“I have a perfect example from two auctions in November held on the same day that were relatively close in size,” Karst said. “The WAPI for the two pieces of land are almost identical, but according to the WAPI, the poorer quality farm sold for twice as much as the other one.”

Just because two farms look equal on paper doesn’t mean they are. Halderman uses the WAPI to track and analyze trends for land sales to compare the price per acre, but it’s not an end all be all number.

Provided by the USDA and NRCS, the WAPI is a summary of the soil types and the corresponding productivity index. While it’s a unique and helpful tool on paper, it simply can’t account for variables that are difficult or even impossible to quantify, like location and reputation.

“These two farms, one in Cass County and the other in Delaware County, are dozens of miles apart, so they almost aren’t comparable because of that,” Karst explained. “Most farmers understand this easily, but an investor might look at the WAPI and say they would buy the Cass County farm all day long. But when they go to sell or rent it, it will be less valuable.”

“These two farms, one in Cass County and the other in Delaware County, are dozens of miles apart, so they almost aren’t comparable because of that,” Karst explained. “Most farmers understand this easily, but an investor might look at the WAPI and say they would buy the Cass County farm all day long. But when they go to sell or rent it, it will be less valuable.”

Karst stands by his previous statement that land is always a safe investment before, during, and after inflationary times. However, Karst cautions buyers from purchasing land for a price that doesn’t work out on paper as an investment. Meaning don’t buy land. Buy it regardless of the price if you can’t rent it or sell it for enough to pay the bills.

“The farm in Delaware County was considered one of the best in the area; it was a good, square farm that had been well cared for,” Karst said. “Farm buyers should always look at how easy a farm is to work on.”

The size and shape of a field make a huge difference in the time it takes to plant and harvest. Time is money, and nobody knows that better than a farmer. Ease of access to each piece of a farm will also determine its value and desirability.

“People need to hire professionals when they’re getting land appraised or setting prices for rent,” Karst said. “Someone in the local area can give them insight that nobody else can. The state average is very rarely correct; it’s usually too high or too low.”

On average, about 45% of Halderman buyers are investors, but they aren’t exactly what you’d expect. There are no more investors buying land now than before inflation,” Karst said. “Usually, investors are landowners that already have ground in that county and are looking to expand on that for a tenant.”

That’s not to say that Halderman hasn’t given bid numbers to large-scale investors, but that certainly isn’t the norm. The bottom line is that land value rarely marches along with the average, and statistics can only tell you how a piece of land will sell.