Quarterly Update – Q1 2024

By Lindsay Humphrey

A Look Backward

“Last year we had a strong sales volume in the first quarter, low activity in the second but land prices were extremely good, then we hit the third quarter. We sold a lot of land but saw prices dip a bit more than we expected,” Karst said. “About July through September it was pretty dry and farmers didn’t know what their crop yields would be. When we sold those farms in the third quarter, I think the mini drought had a big effect when combined with lower commodity prices and higher interest rates.”

Despite the dry conditions, many counties in Indiana saw record high yields for their crops. The quantity and quality of last year’s crop was strong, and farmers left 2023 optimistic about the future.

“Thanks to those higher than expected incomes, land prices jumped in November and December and we ended the year on a bang,” Karst said. “As we dove into 2024, we had several January sales with strong prices.”

One noteworthy item from January was the decline in commodity prices. Everyone expected them to bounce back quickly but that has yet to be the case. Unfortunately, corn and beans are hovering below the break-even point.

February was an oddly slow month but Karst doesn’t necessarily have an explanation for that. Some months are simply slower than others for any type of business.

“We had a ton of sales in March and even though we’ve seen prices that are probably 5 percent lower than they were in quarter one last year, that’s not necessarily all bad,” Karst said. “If you think about land prices going down five percent this year, that means you’re still selling at 95 percent of all time high land values.”

Even when commodity prices dipped in 2023, farm income was still well above the 20-year average. Net income over the last three years has been some of the top five or six in history .

Coming Down the Pike

“Unfortunately, 2024 is forecasted to be about 25 percent below 2023 income,” Karst said. “If that happens, we could see some red ink on cash flow come the end of the year.”

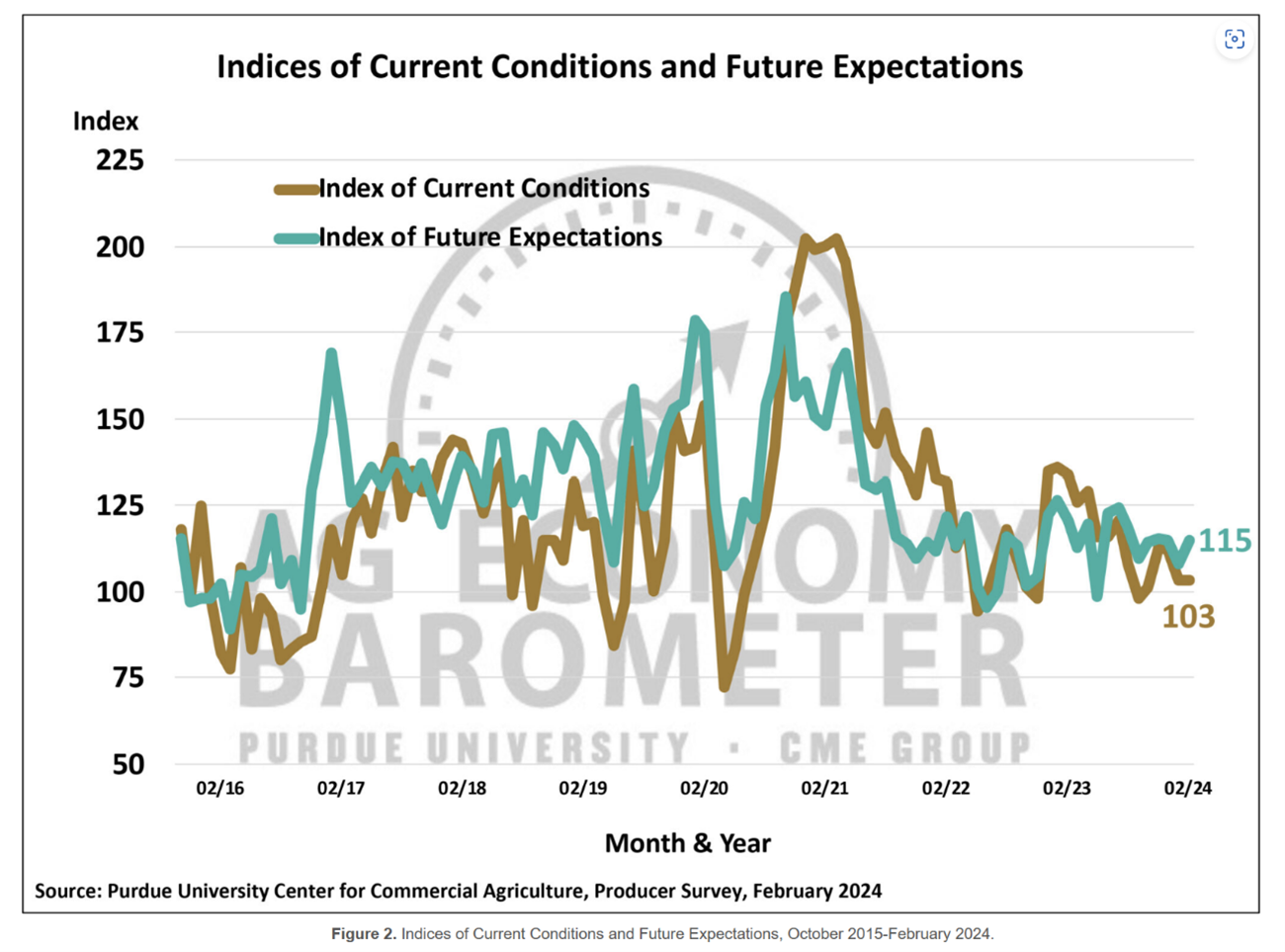

If farming were easy, everyone would do it. Statistically, farmers are still optimistic about the future, at least that’s what the Purdue Ag Economy Barometer says.

“Each month Purdue surveys 400 ag professionals from across the US, mostly farmers, and ask how they feel about certain things,” Karst said. “They’re not really looking for data, they want to know how these people feel.”

On the 200-point scale, 100 is neutral. The only time the index went below 100 was about the time COVID hit.

“What people are worried about now is the erosion of their working capital,” Karst said. “When that happens, they don’t have money for a down payment to buy a farm and have to borrow more money to operate which adds cost to their bottom line. The last time we saw significant erosion of working capital was in 2019.”

Looking at the index, of those surveyed, cautiously optimistic seems to be the sentiment during the first quarter of 2024.

“The land market has been extremely hot for the last two to three years, and I think this might be an opportunity to buy land at a slightly discounted price,” Karst said. “Two years ago, farmers were buying anything and everything that popped up in their area but they’ve started getting a little more selective.”

Of course, interest rates will be a hot topic in the coming year. While the federal government has yet to lower interest rates, many banks have dropped rates on long-term loans for buying real estate. That could be key for Halderman customers who are looking at adding more acres in 2024. If you have any questions about an upcoming sale, how best to sell your farm or about the potential value of your farmland investment please contact your local Halderman representative.